Discover the Potential of Online Forex Trading Platforms

Discover the Potential of Online Forex Trading Platforms

In the ever-evolving world of finance, online forex trading platforms have surged in popularity, offering traders an unparalleled opportunity to enter the foreign exchange markets. These platforms enable individuals to trade currencies with ease and efficiency. For those looking to explore this dynamic field, online forex trading platform Turkiye Brokers provides valuable insights and resources to help navigate the complexities of forex trading.

Understanding Forex Trading

Forex trading, or foreign exchange trading, involves the buying and selling of currency pairs in a decentralized global market. Unlike traditional stock markets, the forex market operates 24 hours a day, five days a week, and is the largest financial market in the world, with daily trading volumes exceeding $6 trillion. This liquidity makes forex an attractive option for traders, from beginners to seasoned professionals.

The Role of Online Forex Trading Platforms

Online forex trading platforms serve as the gateway for traders to access the forex market. These platforms provide users with the tools and resources necessary to analyze market trends, execute trades, and manage their investments efficiently. Key features of online forex trading platforms include:

- User-friendly Interface: Most platforms offer intuitive interfaces that make it easy for traders of all experience levels to navigate and execute trades.

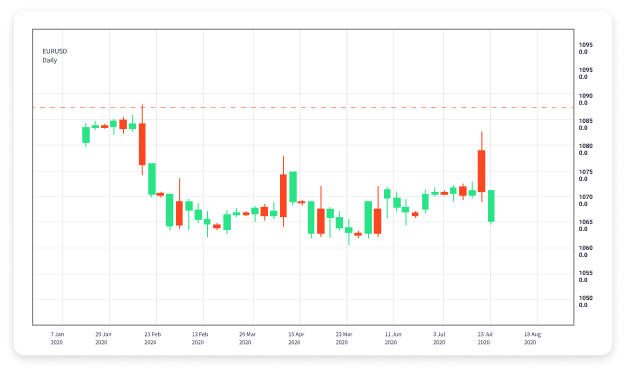

- Technical Analysis Tools: Advanced charting tools and indicators help traders analyze price movements and market trends.

- Real-time Data: Access to live quotes and market data allows traders to make informed decisions based on current market conditions.

- Risk Management Features: Tools such as stop-loss orders and take-profit orders help traders manage their risk effectively.

- Mobile Trading App: Many platforms offer mobile apps that enable users to trade on-the-go.

Choosing the Right Trading Platform

Selecting the appropriate online forex trading platform is crucial for a successful trading experience. Here are some factors to consider when choosing a platform:

- Regulation: Ensure that the platform is regulated by a reputable financial authority to guarantee the safety of your funds.

- Fees and Spreads: Compare the fees associated with different platforms, including spreads and commissions, as they can significantly impact your profitability.

- Execution Speed: Choose a platform known for its fast trade execution to capitalize on market movements.

- Customer Support: Reliable customer service is essential, especially when facing technical issues or urgent inquiries.

- Educational Resources: Look for platforms that offer educational materials, such as webinars and tutorials, to enhance your trading skills.

Benefits of Online Forex Trading

The rise of online forex trading platforms has introduced numerous benefits for traders:

- Accessibility: With an internet connection, anyone can access the forex market from anywhere in the world.

- Low Capital Requirements: Many brokers offer the ability to start trading with a small initial investment, making it accessible to a wide range of traders.

- Leverage: Forex trading platforms often provide leverage, which allows traders to control larger positions with a smaller capital investment.

- Diverse Trading Options: Traders can choose from a wide range of currency pairs, allowing for flexible trading strategies.

Common Trading Strategies in Forex

Successful forex trading often relies on effective strategies tailored to individual trading styles. Some common trading strategies include:

Day Trading

Day trading involves executing multiple trades within a single day, aiming to capitalize on short-term price movements. Traders use technical analysis and quick decision-making to take advantage of market volatility.

Swing Trading

Swing trading is a medium-term strategy that seeks to profit from price swings over several days or weeks. Traders analyze market trends and use technical indicators to determine entry and exit points.

Position Trading

Position trading involves holding trades for an extended period, often weeks or months, based on fundamental analysis and long-term market trends.

Risk Management in Forex Trading

Risk management is a critical aspect of successful forex trading. Effective risk management helps traders protect their capital and minimize losses. Here are some strategies to manage risk:

- Use Stop-Loss Orders: A stop-loss order automatically closes your position when the market reaches a specified price, limiting potential losses.

- Determine Position Size: Calculate the appropriate position size based on your capital and risk tolerance.

- Diversify Your Portfolio: Spread your investments across different currency pairs to reduce overall risk.

- Maintain a Trading Journal: Keep track of your trades and analyze your performance to learn from mistakes and refine your strategies.

Conclusion

Online forex trading platforms have transformed the way individuals approach foreign exchange trading, offering a wealth of tools and resources for traders worldwide. By understanding the features of these platforms, conducting thorough research, and implementing effective trading and risk management strategies, traders can maximize their potential in the forex market. Whether you’re a beginner or an experienced trader, the opportunities within the forex market are vast and accessible.