Build a deposit inside the a bloodstream bank

To find out more, find Setting 3468, Investment Credit (and its own instructions), and you may Inner Cash Password area 170(f)(14). If your car’s FMV is at least $250 but not more $500, you really must have an authored declaration from the certified team acknowledging your donation. The brand new statement need to hold the advice and you will meet up with the examination to possess an acknowledgment discussed lower than Deductions of at least $250 however More than $five-hundred under Substantiation Standards, later. The fresh benefits need to be designed to an experienced organization and never arranged to be used from the a specific people. The ensuing list gives some examples from certified groups.

NBKC Bank Everything Account

Most other purchases such (but not limited to) other person to Individual payments, transmits so you can mastercard otherwise transfers between U.S. Occasionally, yes, you could start with your the newest family savings following starting. Including, Chime and you may SoFi give virtual notes you can to your electronic handbag straight away as you await an actual card to reach in the send. After starting your own cellular app, you might usually relate with external profile to fund your account, establish lead deposit, install expenses spend, relationship to peer-to-fellow software such Dollars App and stuff like that.

Alliant are an on-line credit relationship offered to almost someone within the the newest You.S. You just need to register Promote Proper care so you can Victory, Alliant’s foundation mate. Instead, for many who benefit an enthusiastic Alliant partner otherwise are now living in a good qualifying part, you can even meet the requirements rather than joining Promote Care in order to Achievement. From schools so you can companies, spiritual groups to help you neighborhood gatherings, the top Purple Coach is also roll up just about anywhere you will find blood donors in a position to save lifetime.

You do not instantaneously discover composed communication in the expected language. The brand new Internal revenue service’s dedication to LEP taxpayers try an integral part of a great multiple-year schedule one began delivering translations inside the 2023. You will still discover communication, and sees and you will letters, inside English up to he’s interpreted for the popular words.

The new account has no monthly costs, brings use of a wide Automatic teller machine system, and provides constant happy-gambler.com web sites debit credit perks — around 2% cash return within the informal groups if you set up no less than $1,one hundred thousand within the month-to-month head places. Fulton Lender, headquartered within the Lancaster, PA, given an advantage as much as $250, with no head deposit requirements. So you can make the most of a good $2 hundred added bonus, you’d to start a simply Savings account and employ their contactless debit credit and then make at the very least 15 requests, totaling at the least $three hundred, in the earliest 60 days out of account starting. You might earn some other $50 by opening a statement Bank account online and depositing during the minimum $step one,one hundred thousand within the the fresh currency within the earliest two months.

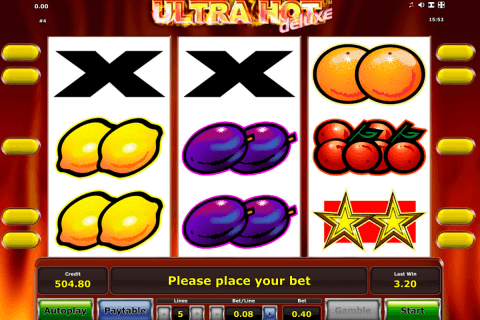

Playing with no-deposit incentives intelligently can also be somewhat improve your betting feel. Boosting the benefits of these bonuses allows for far more enriching game play as opposed to risking my money. So it legal structure allows people to activate rather than financial risk due to the no deposit extra doing work less than sweepstakes regulations. Of many higher RTP position game were additional features, for example free spins and added bonus series, that will boost your earnings even further. To experience highest RTP ports generally also offers greatest chances of profitable, especially when making use of incentives effortlessly.

First Nebraska Borrowing from the bank Connection

If or not make use of the new tickets or other rights does not have any impression on the count you could deduct. Yet not, if you get back the newest admission to the accredited team to have resale, you can deduct the whole number your purchased the newest ticket. 590-B, Accredited charity shipping one to-time election, for more information. Gambling enterprise Mouse click’s no-deposit added bonus also provides new registered users the chance to start to play rather than financial union. Just after viewing the different also provides and the qualified game offered, people should choose nice incentives that give a top 1st value and you can game that have low home edges for optimum potential output.

You also cannot subtract travelling, dishes and you may lodging, or other expenses for your spouse otherwise college students. You don’t need to reduce your sum by the property value any better you will get when the each of the following are real. Visit Internal revenue service.gov/Versions to find latest variations, guidelines, and you will books; label 800–829–3676 to find earlier-seasons forms and you may tips.

You wear’t you would like a timeless family savings to enjoy the interest rate and you will security away from lead put. Prepaid service notes, cellular purses, and neobanks all make it possible to receive money reduced when you’re avoiding look at-cashing fees and the risks of report monitors. SoFi also provides a modern-day financial experience in solid perks for all of us who require direct put instead of traditional financial problems.

Axos features a top-give checking choice for users whom take care of high balances, discover monthly direct deposits and you can/otherwise have an Axos mortgage. You can begin having Very important Examining for earliest day-to-time checking requires, then change to Advantages Checking if the condition transform. Not merely have there been no minimal deposit requirements otherwise account starting costs, however, there are no lingering otherwise purchase will cost you. Throughout the days of monetaray hardship, it’s simple to ruin their banking reputation. Overdraft fees, bounced checks, otherwise involuntary membership closures belong to their ChexSystems declaration, that can prevent you from getting antique checking membership. There are a few banking companies and you can credit unions on the market one render certain rather ample offers without the need for head places.

- Navy Government Borrowing from the bank Relationship also provides membership so you can energetic-responsibility otherwise retired people in the brand new armed forces as well as their family.

- The new cuatro.25% APY changeable speed render is actually for qualified account having balance out of $0.01 – $5,100000,100000.

- You could import funds from you to definitely Varo membership to another with Varo to People repayments.

The savings account not just also provides a top APY, however, includes the possibility to include an automatic teller machine card. You might deposit currency by the moving funds from an outward membership, playing with cellular consider deposit otherwise mailing a or lead deposit. Which have bad credit otherwise a bad financial listing doesn’t imply your’re also closed out of the financial system.

- Particular industrial companies and change teams publish car or truck rates books, aren’t named “bluish guides,” which includes over specialist selling cost otherwise dealer mediocre prices for previous model decades.

- This site doesn’t come with all of the companies otherwise issues available in this the market industry.

- Put simply, it predict one to put in the future, otherwise your money would be finalized otherwise forfeited.

- Their 360 Family savings doesn’t features at least put requirements or monthly maintenance percentage, so there are no charges to own overdraft shelter.

- It’s unusual to locate an excellent debit card with a bank account, but you can consult one with this membership to help you more easily availableness the money.

- Along with, you can even receive the fund instantly to possess a little commission and you can wear’t need to pay attention.

Varo is one example of a bank who’s no harmony conditions. Of a lot banking institutions offer the new membership bonuses providing you see the newest requirements. When you’re generating a new account added bonus will likely be a added bonus, i wear’t highly recommend choosing a financial exclusively centered on a-one-time provide.

In addition to find Contributions Of which Your Benefit under Benefits You simply can’t Deduct, after. You could subtract their benefits as long as you create them to a qualified organization. While we can be’t behave in person to each and every opinion acquired, we create take pleasure in your views and can consider carefully your statements and you will guidance while we inform all of our tax models, recommendations, and you can guides. Don’t send tax concerns, tax returns, or money on the a lot more than address. You should done Point B away from Form 8283 for each item—otherwise group of comparable low-dollars items— in which you claim a great deduction of over $5,000 but because the provided inside the Deductions Over $5,000, later on.

You can generate as much as 0.25% APY on the stability from $15,000 or higher, and you can stability lower than $15,000 secure 0.10% APY. SpotMe to the Borrowing is actually an optional, zero attention/zero fee overdraft line of credit linked with the brand new Shielded Put Account. SpotMe on the Debit is actually a recommended, zero payment provider connected to the Chime Family savings (individually or collectively, “SpotMe”). Qualifications to own SpotMe demands $200 or higher inside being qualified head places on the Chime Examining Membership each month. The fresh Annual Fee Produce (“APY”) on the Chime Family savings try varying that will changes from the when.